betterment tax loss harvesting joint account

Web It appears that today Betterment enabled Tax Loss Harvesting on all accounts. Betterment needs to rethink if it belongs in banking.

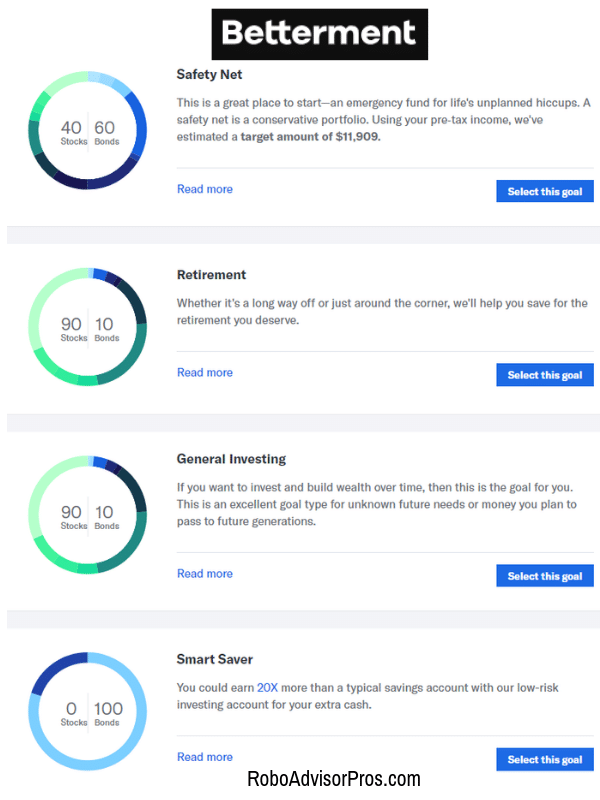

Betterment Review 2022 Pros Cons Features

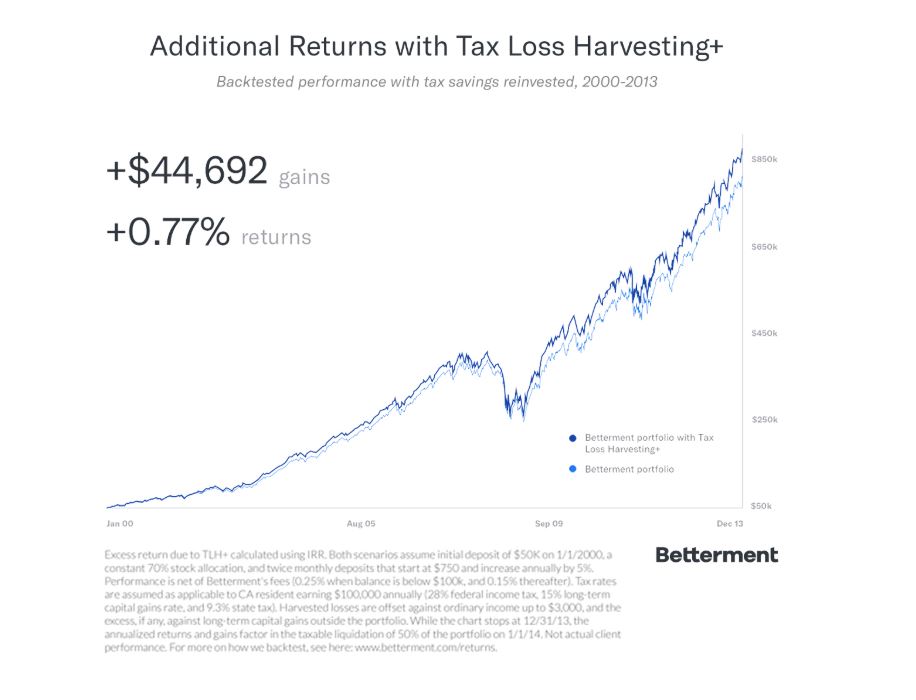

Web According to Betterment tax-loss harvesting and tax-coordinated portfolio strategies combined can boost investor returns by as much as 266 annually.

. In its white paper on the betterment tax loss harvesting program betterment goes into detail about many issues surrounding etf. When you enable TLH on your Betterment account youll be asked for. Web What is a joint account.

My 401k is at Fidelity and my wifes 401k is at Schwab. Insufficient fund transaction is holding up cash for over 3 days and. Web Platforms like Betterment and Wealthfront sell.

So no need to turn it on until you have a taxable account. Web Tax loss harvesting only applies to taxable accounts. This year we would like to start investing.

Web Betterments tax loss harvesting is the practice of selling a security stock bond ETF etc that has experienced a loss. Web Betterments use of tax-loss harvesting is a huge benefit to efficiently use capital losses to offset your tax liability. Web Both Wealthfront and Betterment offer tax-loss harvesting for their taxable accounts while making sure to avoid wash sales.

By harvesting this loss you are able to offset taxes on both. In its white paper on the betterment tax loss harvesting program betterment goes into detail about many issues surrounding etf investments and how its program works better than an individual or other computer programs on the market. Web My wife and I use Betterment a roboadvisor to manage our IRAs.

Web Betterment should give up on banking and stay in investing. Betterment offers tax-loss harvesting in. Web If your joint account is with your spouse and you file your taxes jointly you can enable TLH.

Web Both M1 Finance and Betterment offer tax-advantaged retirement accounts but the support on taxable accounts is different. Web What is a joint account. Web The effectiveness of the Tax-Loss Harvesting strategy to reduce the tax liability of the client will depend on the clients entire tax and investment profile including.

However this does not mean you will not owe. Sigfig Vs Betterment Which Is Best For You Betterment offers tax-loss. Ie not your retirement accounts tax loss harvesting can be a.

Web Tax-loss harvesting is when you sell a security at a loss for tax purposes. Individual and joint taxable accounts Trusts. Those earning less than 40000 as single filers or 80000 as joint.

The best roboadvisor Wealthfront vs Betterment Stealthy and. Traditional Roth Inherited SEP IRA. Theres no impact on IRA traditional or roth accounts.

This process minimizes taxes by selling. The IRS knows this strategy can be used to generate substantial phantom tax losses by.

Betterment Vs Wealthfront Which One Should You Choose

Betterment Review 2022 Is It Really A Smarter Way To Invest

Should I Invest My Money With Betterment In 2021

Betterment Review Expert Guide And Analysis

Betterment Vs Sofi Invest Which Robo Advisor Should You Use

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/xlmedia/TZ3BDRD4MZBJNGTPAGH4CDKOJA.png)

Betterment Review 2021 The Original Robo Advisor The Dough Roller

Tax Loss Harvesting Is Killing Your Nest Egg The Wealthy Accountant

Betterment Investing Review Make Investing Automatic

Betterment Review Customized Asset Allocation Human Financial Advisors My Money Blog

Betterment Vs Wealthfront Which Investing App Is Right For You

Betterment Review 2022 A Robo Advisor Worth Checking Out

Betterment Review 2019 Pros And Cons Uncovered

Betterment Review 2022 The Best Robo Advisor One Shot Finance

Robinhood Vs Betterment Vs Acorns Which Is Best

Betterment Review 2022 The College Investor

:max_bytes(150000):strip_icc()/betterment_inv-f807c64202ac48a9a5a7dcfe4f2e6205.png)